Executive Summary

CEM Wealth is a strategic digital transformation of the traditional investment landscape in Sri Lanka. Recognizing a significant "Financial Literacy Gap," we designed a dual-sided dashboard ecosystem that bridges the divide between retail investors and Registered Investment Advisors (RIAs).

The platform serves as both a transparent marketplace for financial products and a high-fidelity analytical tool for consultants. By transitioning users from passive savers (Fixed Deposits) to active, informed investors, CEM Wealth democratizes wealth management for everyone from young professionals to retirees.

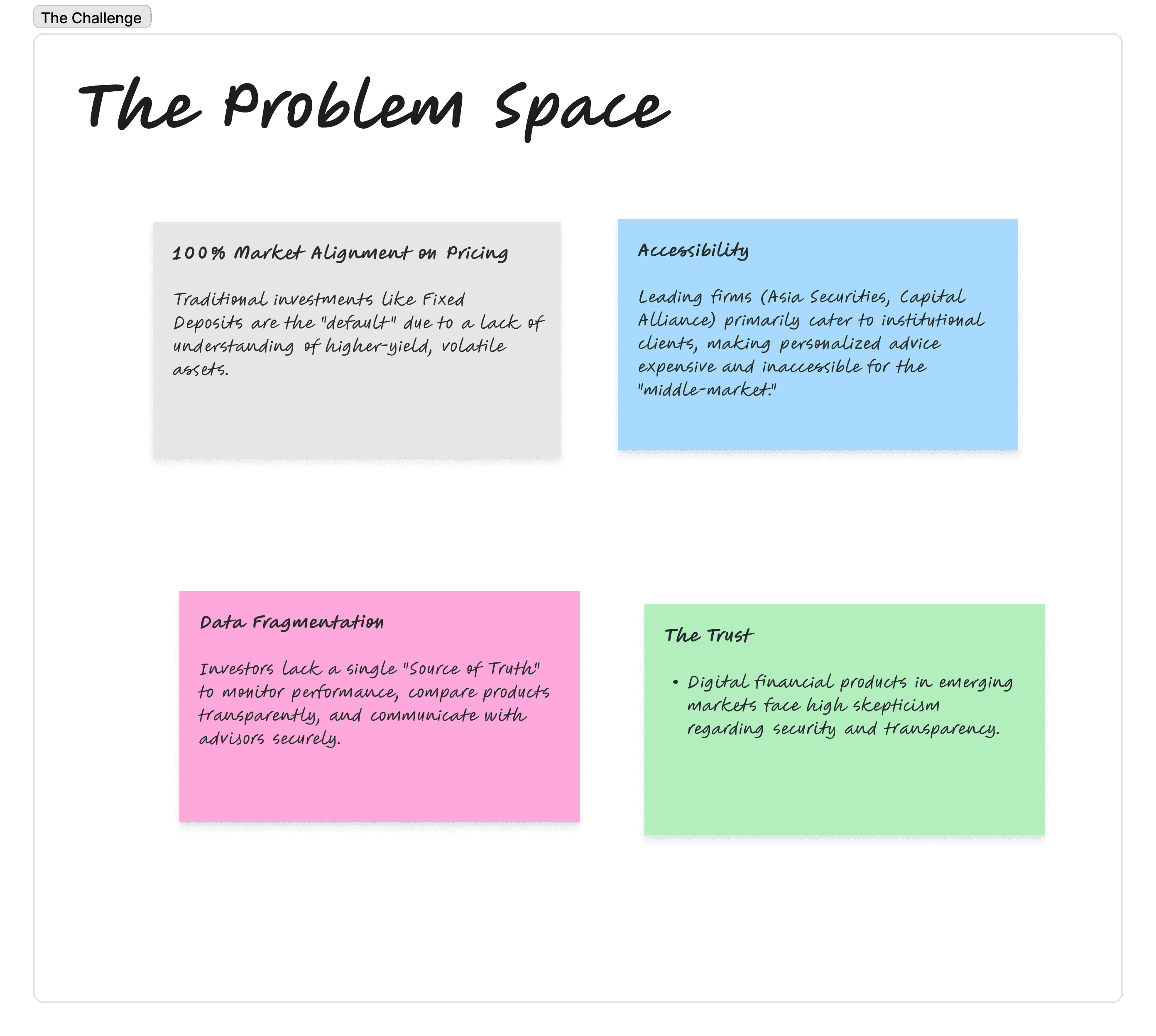

The Challenge

In Sri Lanka, the wealth management sector is traditionally reserved for high-net-worth individuals (HNWIs), leaving the average earner with limited options and a lack of professional guidance.

User Research & Discovery

Type | Persona | Core Pain Point | Goal |

|---|---|---|---|

The Aspiring Investor | Young professional with limited savings. | Intimidated by jargon; doesn't know where to start. | Build a long-term portfolio with low-risk entry points. |

The Active Wealth Builder | Mid-career professional / Retiree. | Difficulty tracking performance across multiple assets. | Maximize yield through RIA-guided diversification. |

The RIA (Advisor) | Licensed Financial Consultant. | Managing 50+ clients manually via email/WhatsApp. | Scale consultations using data-driven analytical tools. |

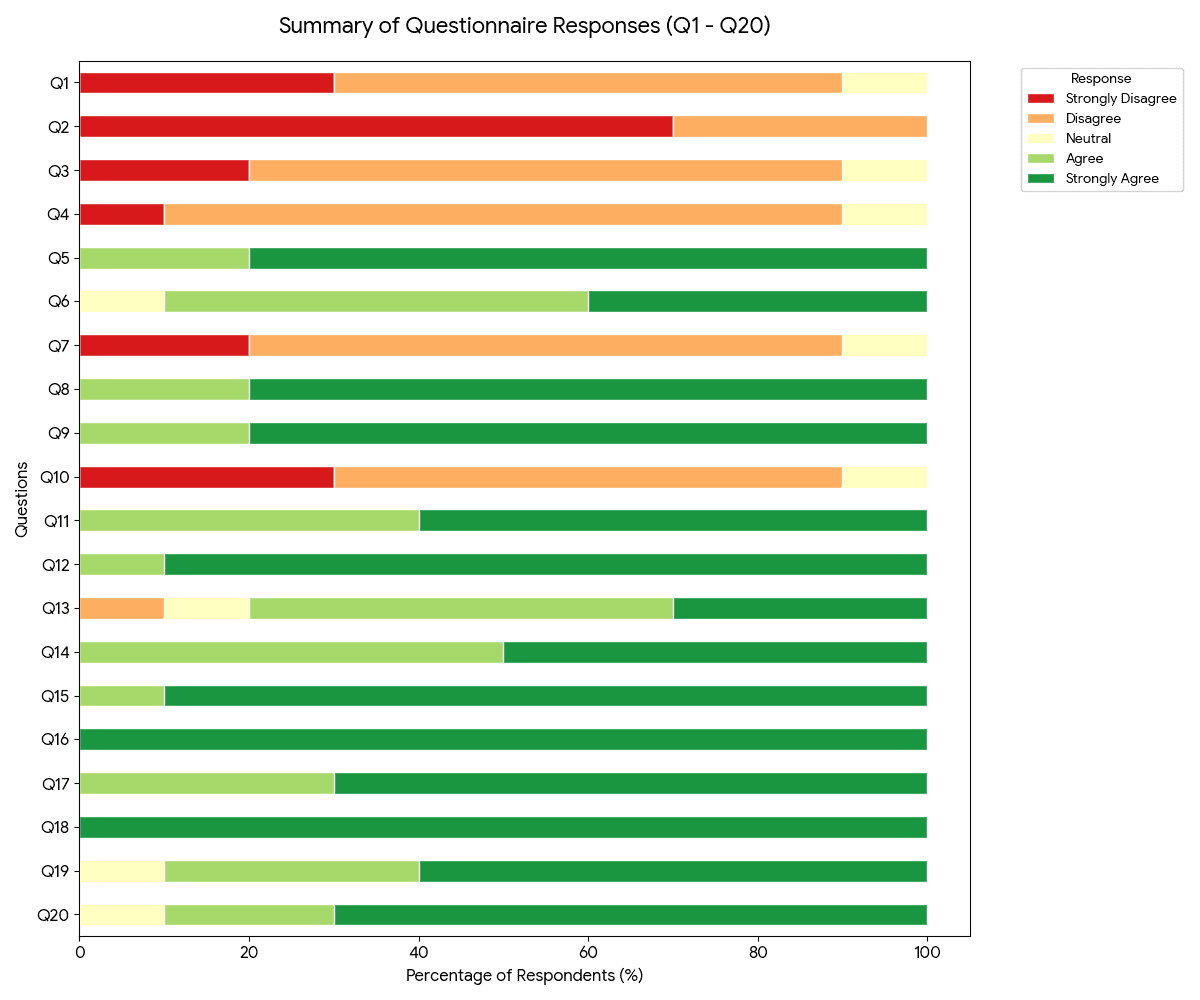

Questions and summary responses to from candidates

Question | Question | Category |

Q1 | I have a clear understanding of the risk levels in my current investments | Risk Assessment |

Q2 | I can easily monitor and track the performance of all my investments in one place | Risk Assessment |

Q3 | I understand how economic factors affect my portfolio | Risk Assessment |

Q4 | I have easy access to reliable information about investment opportunities | Access to Information |

Q5 | I find it difficult to get personalized investment advice | Access to Information |

Q6 | Investment information in Sri Lanka is too technical or complicated | Access to Information |

Q7 | I know where to find trustworthy financial advisors | Professional Advisory |

Q8 | The cost of professional financial advisory services is too high | Professional Advisory |

Q9 | Wealth management services are only for very wealthy people | Professional Advisory |

Q10 | I feel confident about where to invest my money | Investment Confidence |

Q11 | I often feel uncertain or anxious about my investment decisions | Investment Confidence |

Q12 | I wish I had professional guidance before making investment decisions | Investment Confidence |

Q13 | Language barriers make it difficult to understand investment products | Current Challenges |

Q14 | I don't have enough time to properly research investments | Current Challenges |

Q15 | I struggle to find unbiased investment advice | Current Challenges |

Q16 | I would use a platform that provides simple risk analysis | Platform Needs |

Q17 | I would pay a reasonable fee to chat with a financial advisor online | Platform Needs |

Q18 | Having all my investments in one dashboard would be very useful | Platform Needs |

Q19 | I have postponed investments because I didn't know which option to choose | Decision Making |

Q20 | I rely mainly on friends/family for investment advice rather than professionals | Decision Making |

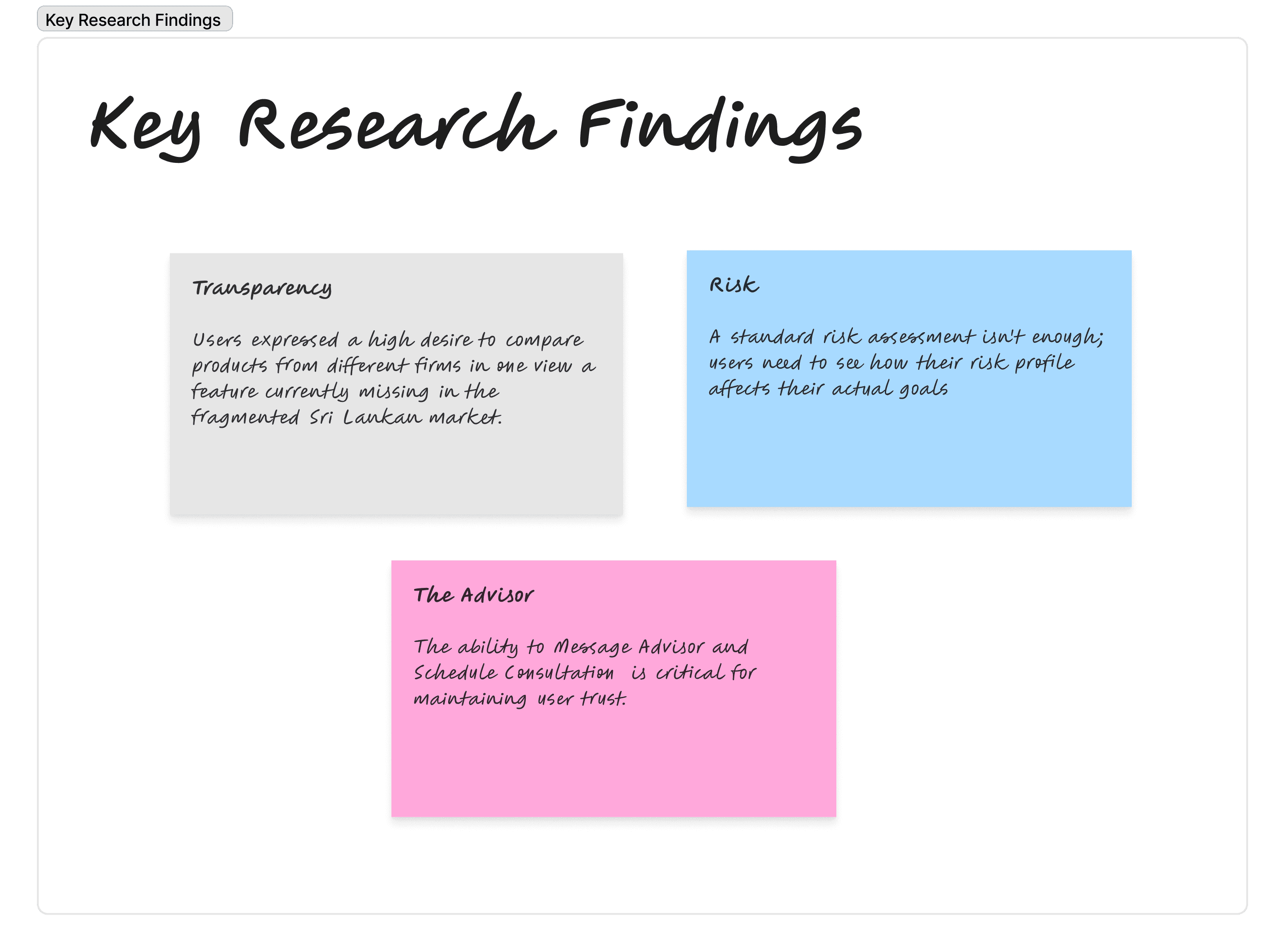

Market Insights & Competitive Gaps

Our analysis of competitors (Vanguard Digital, Netwealth, and local firms) revealed a Gap. International platforms like Interactive Advisors are low-cost but feel Generic.

Competitive Analysis

I conducted a deep dive into both local incumbents and global digital benchmarks to identify UX patterns that could be adapted or improved for the Sri Lankan investor.

Competitor Tier | UX Philosophy | Strengths | The "UX Gap" (Opportunities) |

Institutional Giants (e.g., CAL, Asia Securities) | Document-heavy, high-friction. | Established trust and diverse service portfolios. | High Entry Barriers: Catering primarily to HNWIs and institutional clients, leaving retail investors overwhelmed. |

Global Robo-Advisors (e.g., Betterment, Interactive Advisors) | Low-touch, algorithm-driven. | Seamless onboarding and goal-based interfaces. | The Personalization Void: Lacks the interaction required for high-trust financial decisions in emerging markets. |

Traditional Defaults (Fixed Deposits / Savings) | Zero-cognitive load, low-yield. | Unmatched simplicity and perceived security. | The Growth Trap: Fails to outpace inflation; lacks any data visualization or wealth-building education. |

CEM Wealth (Proposed) | Data-rich but human-led. | Digital Accessibility: Remote consultations and transparent product comparisons. | The Sweet Spot: Combines the simplicity of a digital-first app with the professional security of a Registered Investment Advisor (RIA). |

Strategic Design & Impact

I translated the complex functional requirements into high-impact UX patterns. The following table outlines how specific design interventions directly address the financial literacy and accessibility gaps in the Sri Lankan market.

Proposed Solution | Solving the gap/problem | Primary UX Metric | Possible Impact / Strategic Value |

Goal-Centric Onboarding | High Entry Barrier | Task Success Rate | By replacing generic Account Opening with Setting financial goal, we reduce abstract friction and give users a tangible reason to fund their accounts. |

Visual Risk Profiling | The Personalization Void | Data Accuracy | Enhanced Profile: Transitioning Risk Assessment from a form to an interactive visual model ensures users provide more honest data, leading to better anaysing. |

Unified Comparison | Solves both The Personalization Void & visualization | Decision Velocity | Reduced Decision Fatigue: Providing a transparent UI to compare products from multiple firms allows users to reach an "informed decision" faster than visiting multiple institutional sites. |

Dual-Sync Message Center | Lacks the interaction required for high-trust | User Trust & Retention | Direct Advisor Accountability: Implementing a secure, persistent chat for messaging advisor bridges the gap between digital automation and human trust. |

Contextual Educational Tooltips | Leaving retail investors overwhelmed, therefore educating them on investing | Financial Literacy Score | Lowered Barrier to Entry: By embedding Educational Resources directly into the data visualizations, we educate users at the moment of confusion, rather than requiring them to read external manuals. |

Modular Renewal Widget | Extra: user retention | Churn Rate | Seamless Lifecycle Management: Integrating the subscription renewal within the dashboard flow ensures a path for returning users to maintain their RIA access. |

Comparative Analysis Matrix

This table highlights the strategic positioning of CEM Wealth against existing market solutions.

Feature / Metric | Traditional Banks (FDs) | Local Brokerages | Global Digital Platforms | CEM Wealth |

Onboarding | High Friction (Manual) | Moderate (Document heavy) | Seamless (Digital) | ✅ Seamless + RIA Assisted |

Data Visualization | Minimal (Text-heavy) | Complex (Expert-only) | Intuitive (Trend-based) | ✅ Intuitive + Actionable |

Advisor Access | Physical/Phone | Dedicated (High cost) | AI/Robo-Chat | ✅ Dedicated RIA (In-App) |

Portfolio Goal Tracking | None | Manual/Excel | Automated | ✅ Automated Goal-Matching |

Pricing Transparency | High (Fixed) | Low (Hidden commissions) | High (Subscription) | ✅ High (Subscription/Tiered) |

System Functional Requirements & Strategic Design Pivots

Functional Requirement | User Type | Design Pivot (Solving the UX Gap) |

Digital Onboarding & Goal Setting | Investor | Ask "What are you building for?" instantly lowering the psychological barrier for new investors. |

Algorithmic RIA Matchmaking | Investor | This solves the "Selection Paralysis" common when users are faced with a list of unknown consultants. |

Portfolio Visualization | Investor | Converted complex spreadsheets into high-contrast trend lines |

In-Platform Plan Renewal | Investor | Subscription/renewal cycle solves the churn gap where users traditionally forget to renew or find manual payment processes too cumbersome. |

Marketplace Comparison Engine | Investor | Allowing RIAs to objectively show why one product out-performs another. |

Dual-Sync Communication | RIA / Investor | This moves financial advice away from fragmented apps like WhatsApp into a professional trust. |

RIA Analytical Command Center | RIA | Enabling advisors to manage large client volumes without losing oversight. |

The Design Solution: CEM Wealth

We approached the UI with a "Financial Clarity" design system. This involved using a clean, Swiss-inspired aesthetic that prioritizes white space and high-contrast typography to make numbers easier to read.

Significant Front-End Interfaces are below

User Registration

The form adheres to UX best practices by requesting essential information Full Name, Email, Phone Number, and Password to minimize friction during the sign-up process.

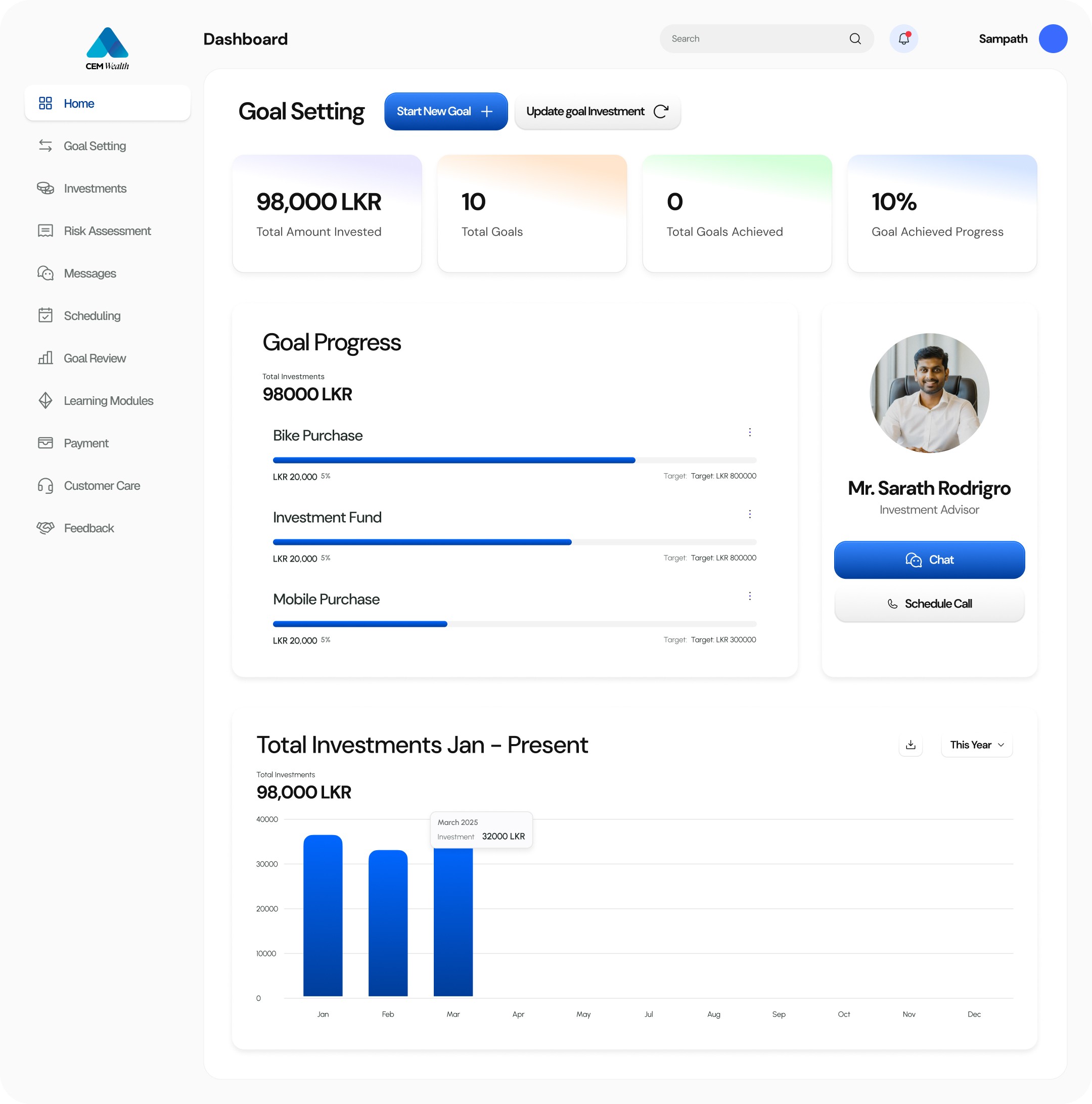

Home Dashboard

The top section uses KPI cards to provide an immediate snapshot of total wealth and progress. The central area visualizes individual goals via progress bars, allowing users to see exactly how close they are to specific milestones.

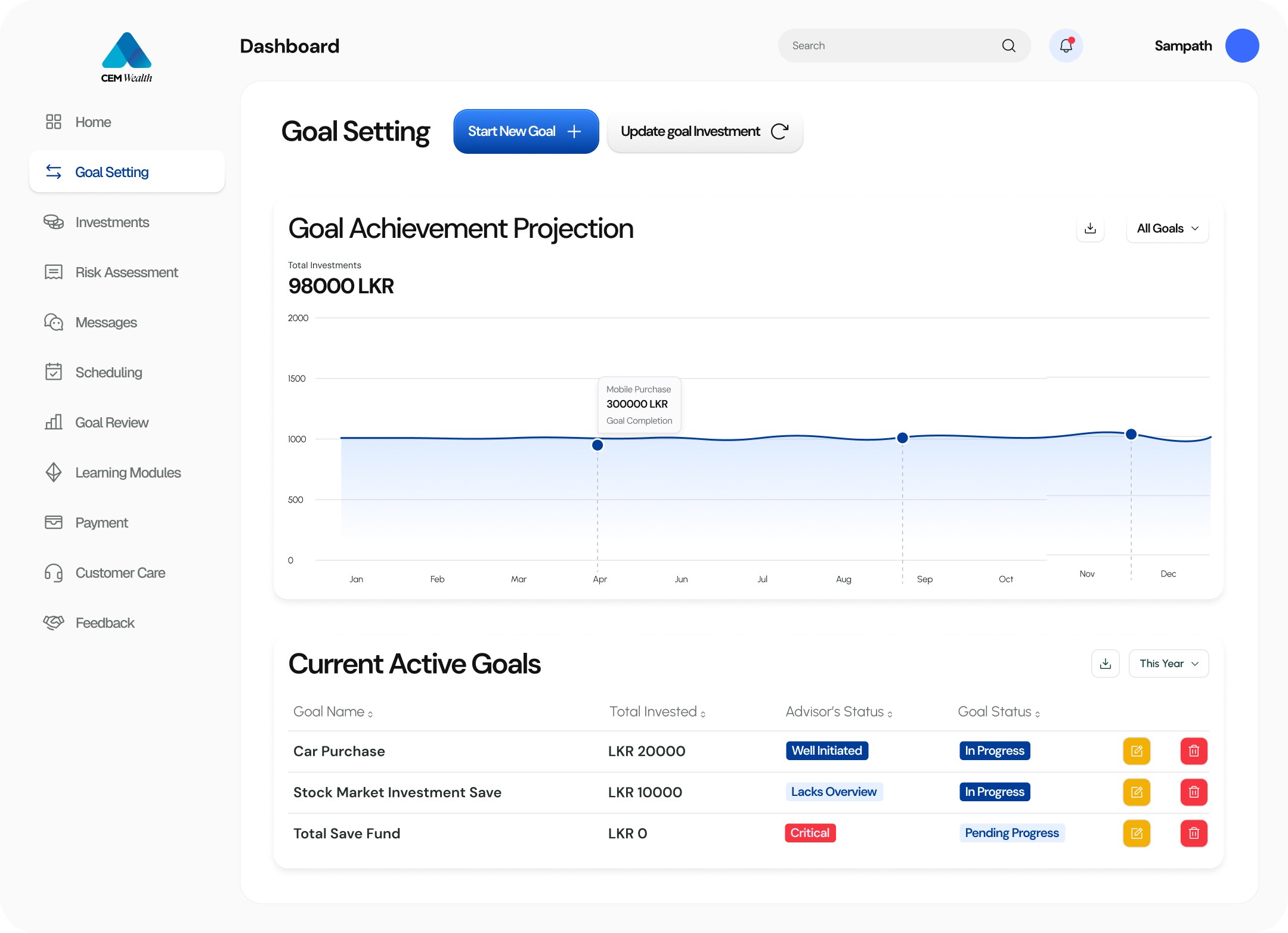

Goal Setting

Features a unique "Advisor's Status" column (e.g., "Well Initiated" or "Critical") and a "Goal Status" tracker, providing qualitative feedback on investment health alongside quantitative data.

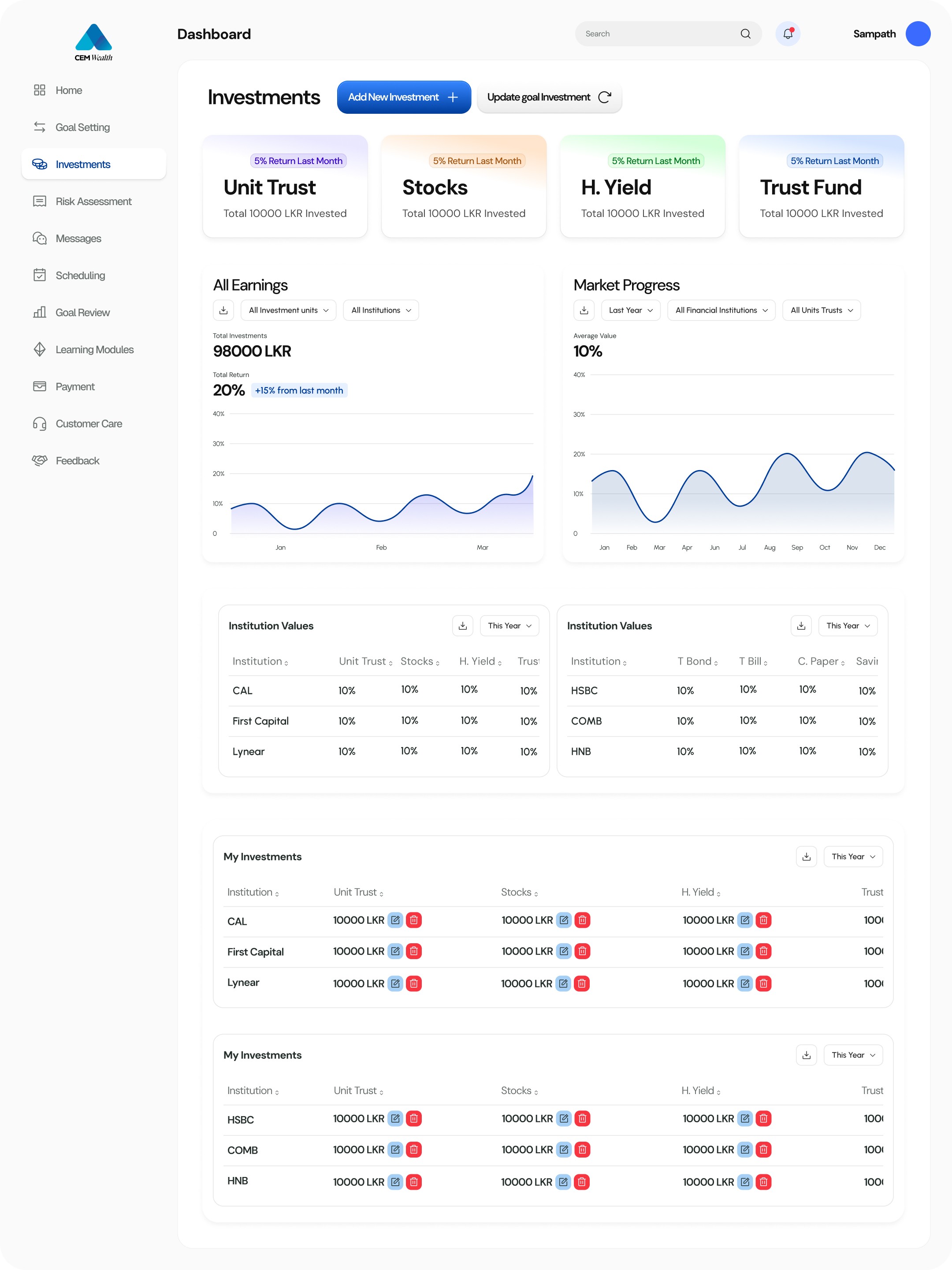

Investment Interface

The top KPI cards categorize investments by type (Unit Trust, Stocks, H. Yield, Trust Fund), providing an immediate view of capital allocation and monthly return percentages for each.

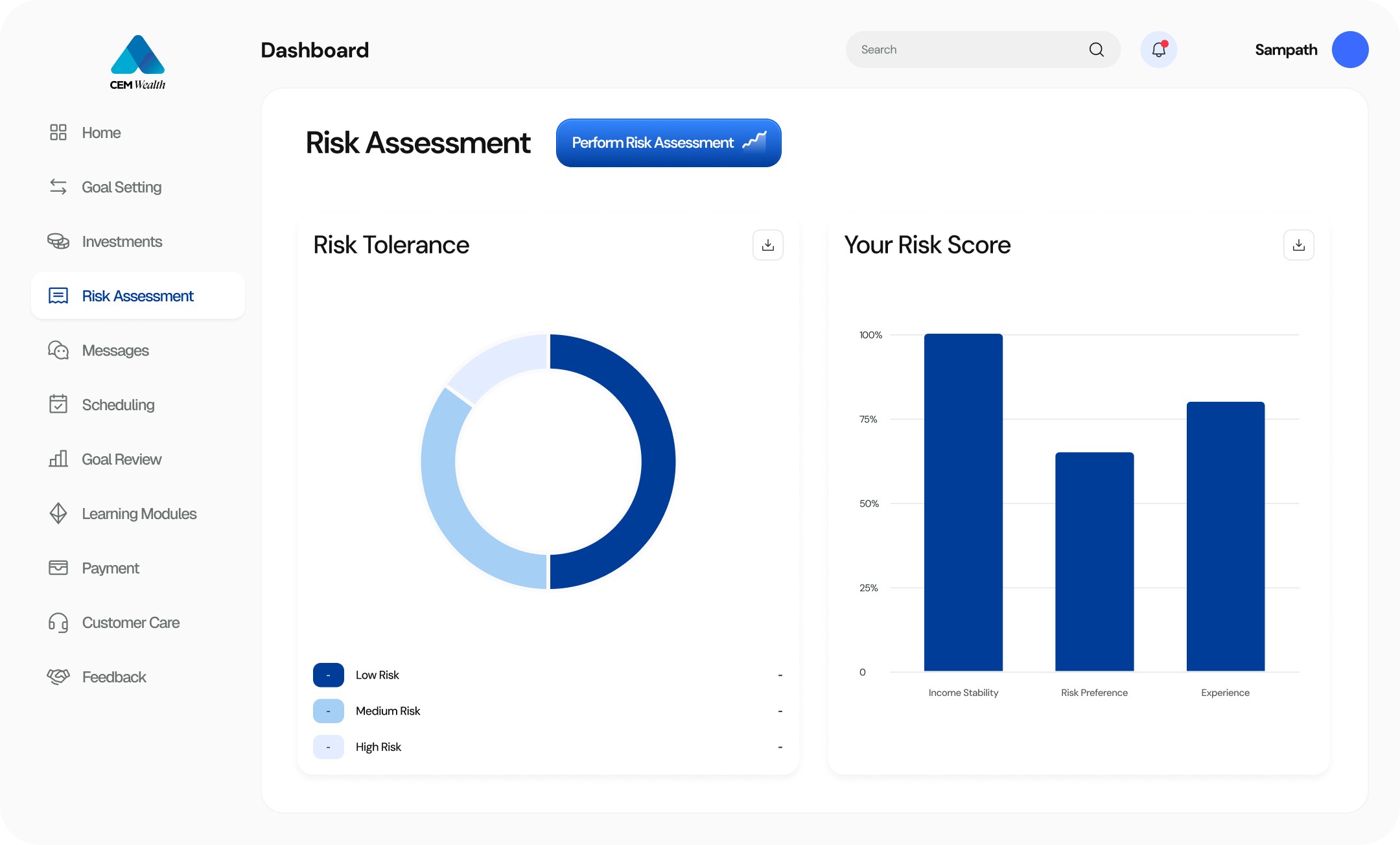

Risk Assessment

The doughnut chart provides a high-level breakdown of the user's risk appetite, categorizing it into Low, Medium, and High Risk zones to guide future asset allocation.

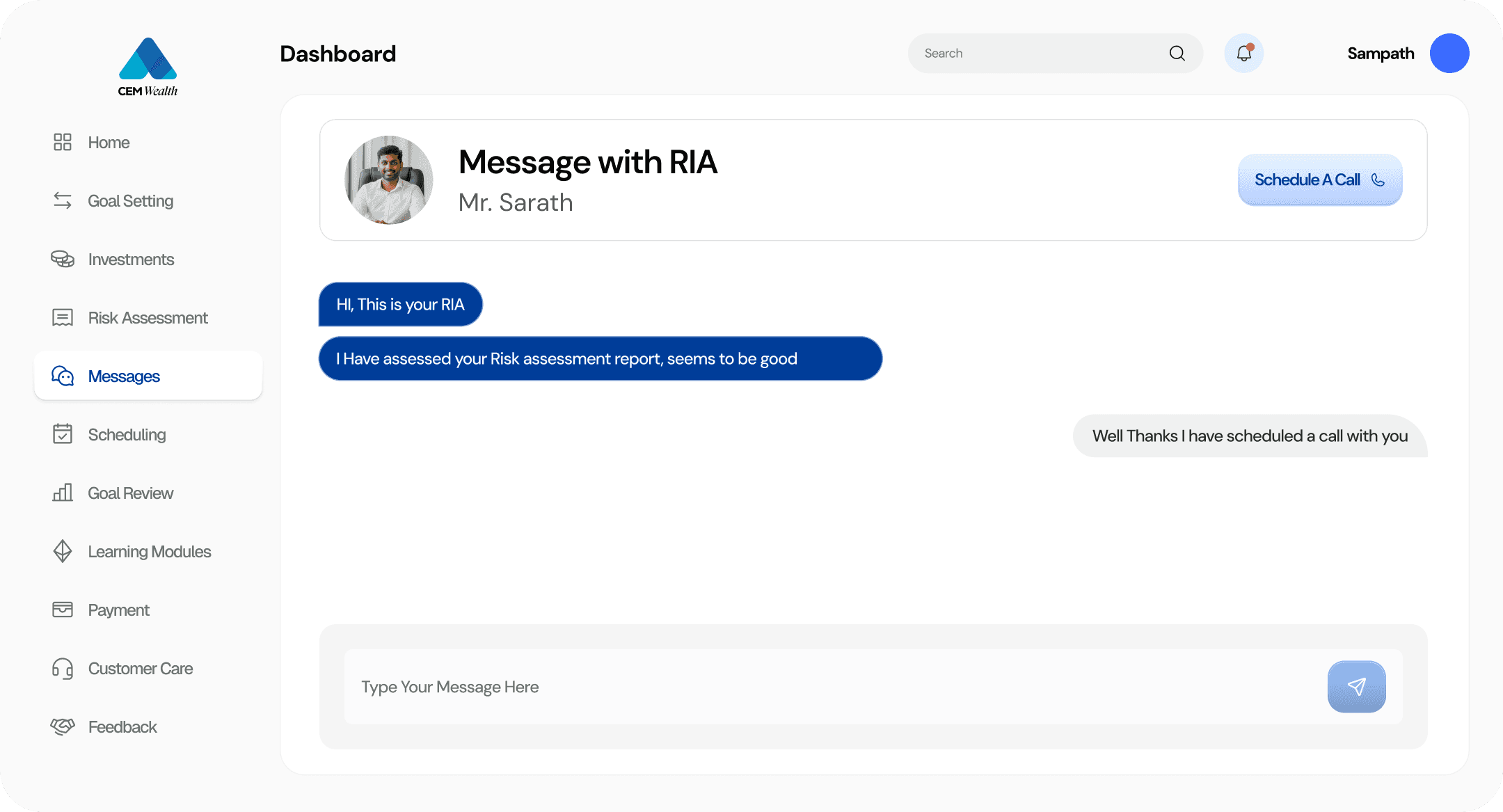

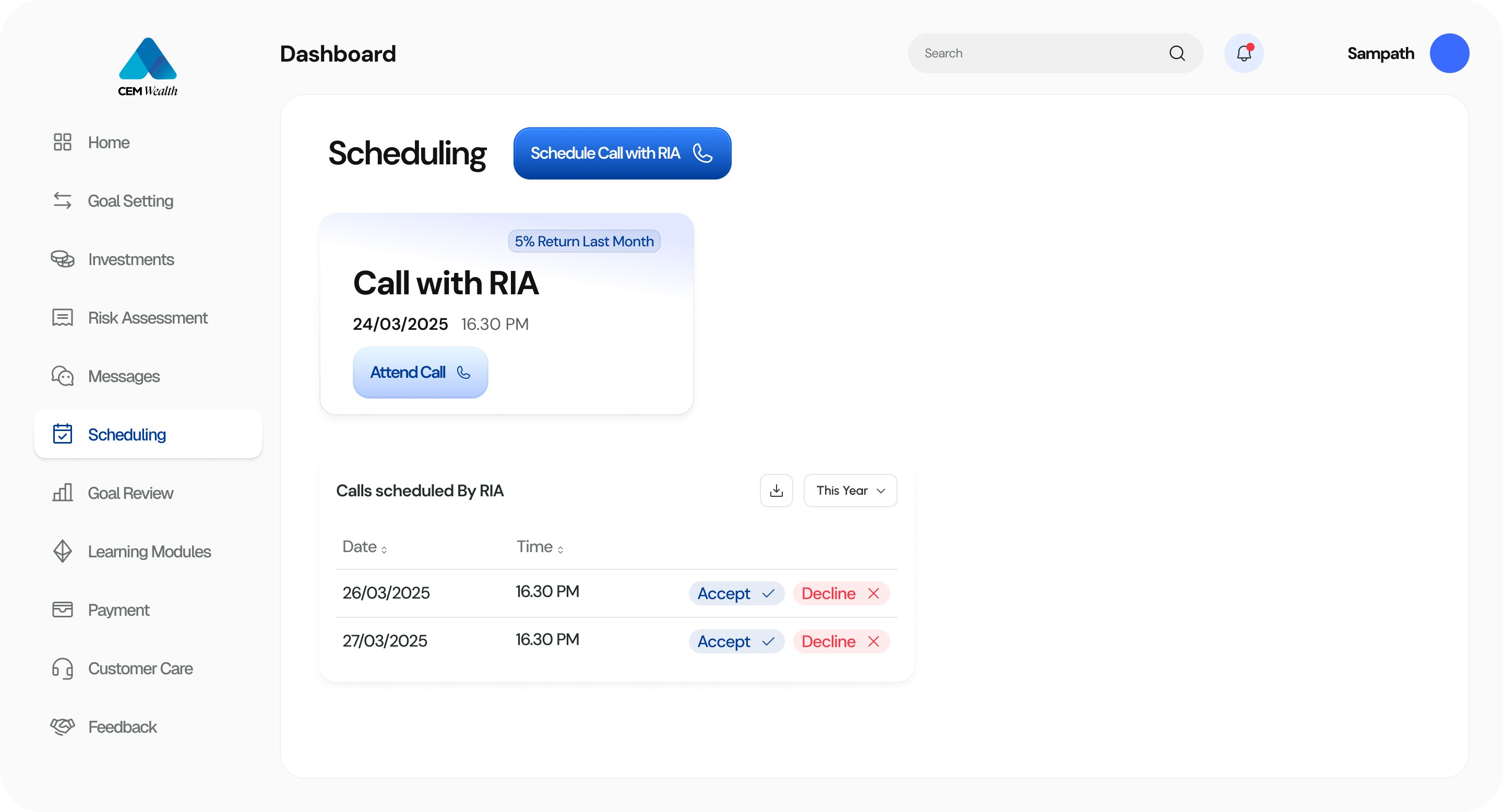

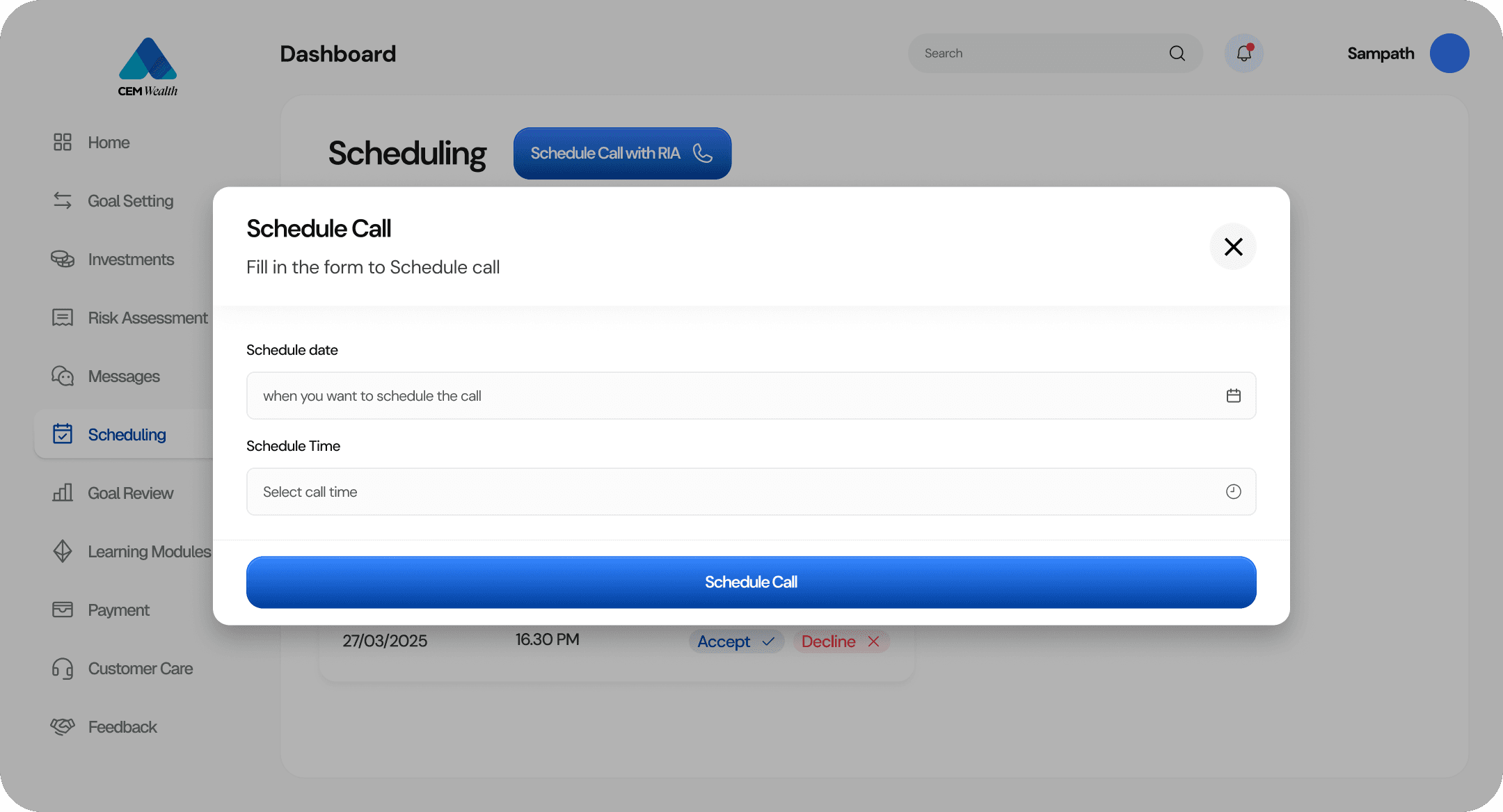

Communication with RIA

Real-time chat interface, an automated call scheduling system, and a centralized meeting manager for tracking and accepting advisor appointments.

Conclusion & Retrospective

The development of CEM Wealth represents more than just a dashboard design; it is a solution to a systemic financial literacy gap in the Sri Lankan market. By shifting the focus from "product-selling" to "goal-achieving," we created an environment where complex financial decisions feel accessible rather than intimidating.

Strategic Impact

Democratized Access: By lowering the barrier to entry through digital onboarding and risk assessment, we opened professional-grade advisory to young professionals and limited-income earners who were previously ignored by institutional giants.

The Human Interaction: Integrating secure messaging and appointment scheduling proved that in high-stakes FinTech, human trust is the most valuable feature.

Ecosystem: The inclusion of an in-dashboard renewal flow ensures long-term user retention and a steady revenue stream for the platform, moving away from one-off transactional models.