Streamlining Financial Operations for Digital Tourism

Digital Tourism is a peer-to-peer platform connecting international travelers with local driver-guides in Sri Lanka. By bridging the gap between independent travelers and local expertise, the platform serves as a cultural gateway, offering immersive experiences that traditional tours often miss.

The Challenge

As Digital Tourism scaled, the reliance on manual booking via social media created a fragmented operational workflow. Managing an extensive network of independent drivers became increasingly complex, particularly regarding financial reconciliation.

The Problem Space

The existing manual system suffered from three critical friction points:

Operational Blind Spots: Inefficient reservation tracking led to communication gaps between the platform and its driver network.

Revenue Leakage: Without a centralized system, the company struggled to track when payments were collected by drivers, leading to delayed settlements.

Information Asymmetry: Drivers lacked a streamlined mechanism to know exactly when and how much to collect from tourists, posing a risk to the brand's professional reputation.

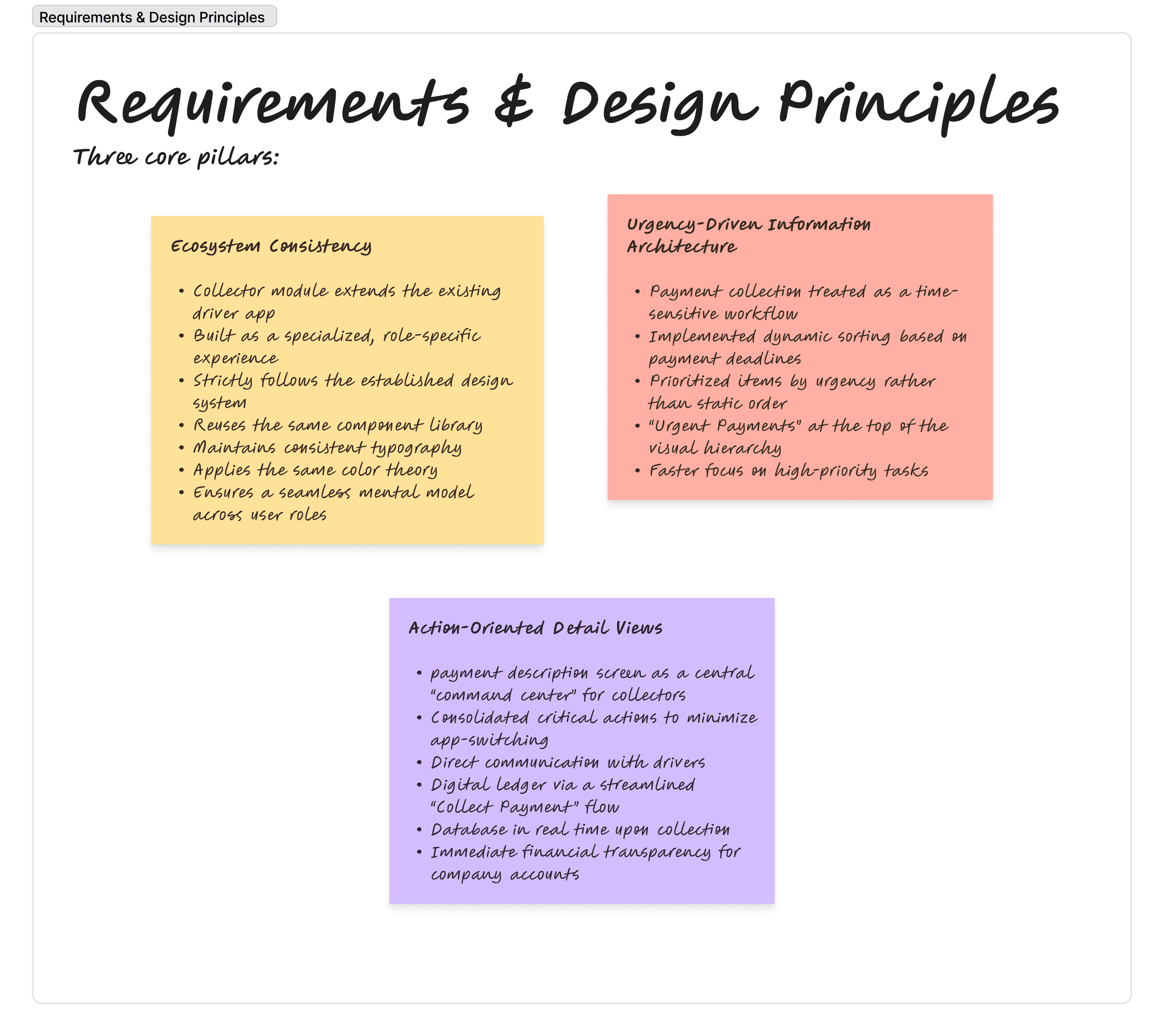

My Role: Designing the Collector Experience

I was tasked with designing the Payment Collector Interface. My objective was to create a high-utility tool that empowers collectors to manage financial transactions with precision and speed.

The Solution: A Data-Driven Financial Command Center

The UI was architected to transform a high-risk manual process into a structured, error-proof digital workflow. Every screen serves a specific stage of the payment reconciliation lifecycle.

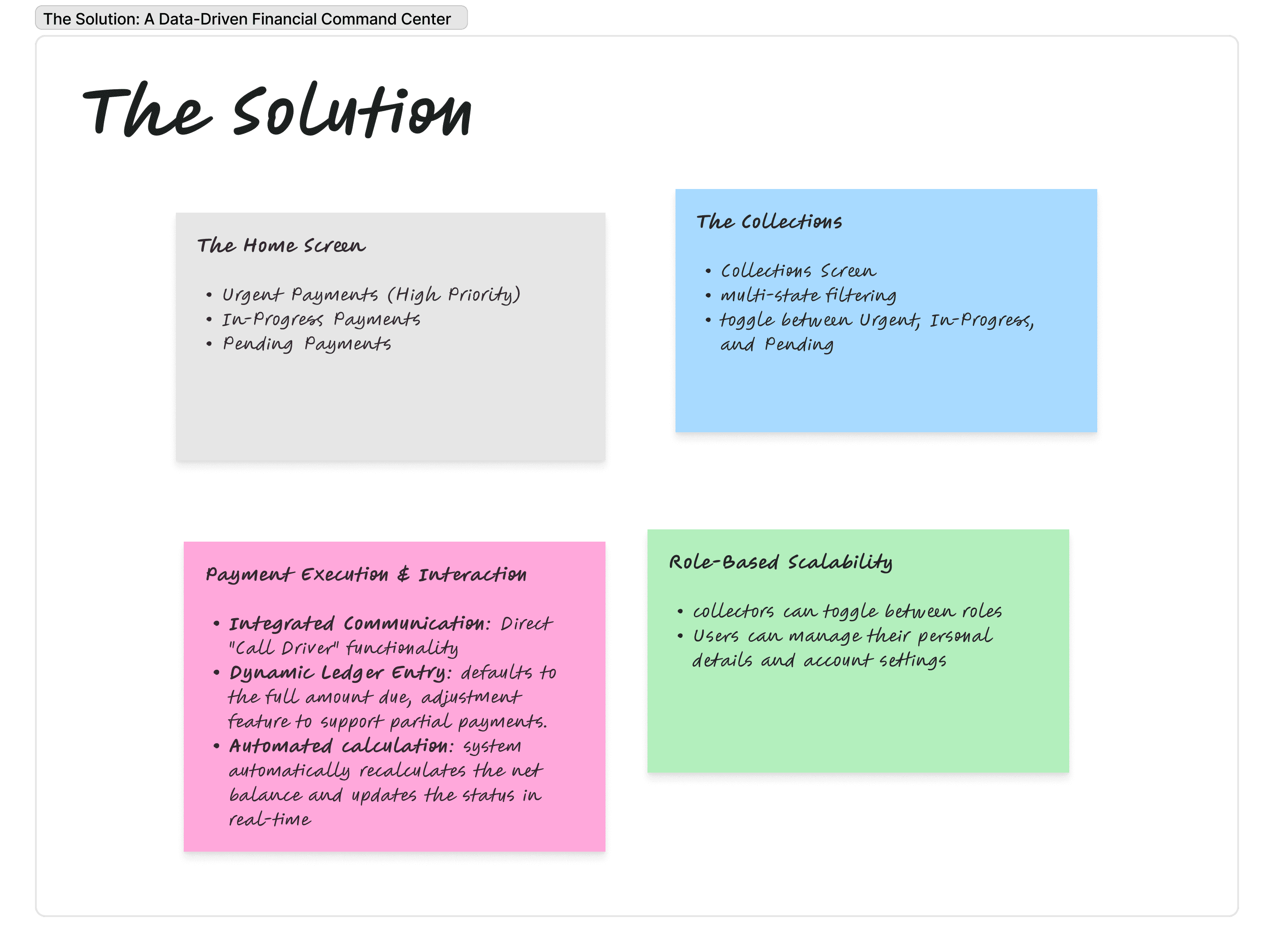

Proposed Solution | Primary UX Metric | Strategic Value |

Urgency-Based Hierarchy | Time-to-Action | Reduced Revenue Delays: Prioritizing deadlines at the top of the feed ensures critical tasks are never missed. |

Dynamic Adjustment Logic | Data Accuracy | Minimized Discrepancies: Allowing manual overrides for partial payments ensures the digital ledger matches real-world cash flow. |

Integrated Call Triggers | Efficiency | Operational Speed: One-tap driver contact within the payment screen removes friction from the collection process. |

Dual-Role Profile Switcher | User Retention | System Scalability: Simplifies the UX for power users holding multiple responsibilities within the Digital Tourism network. |

Designing the User Interfaces

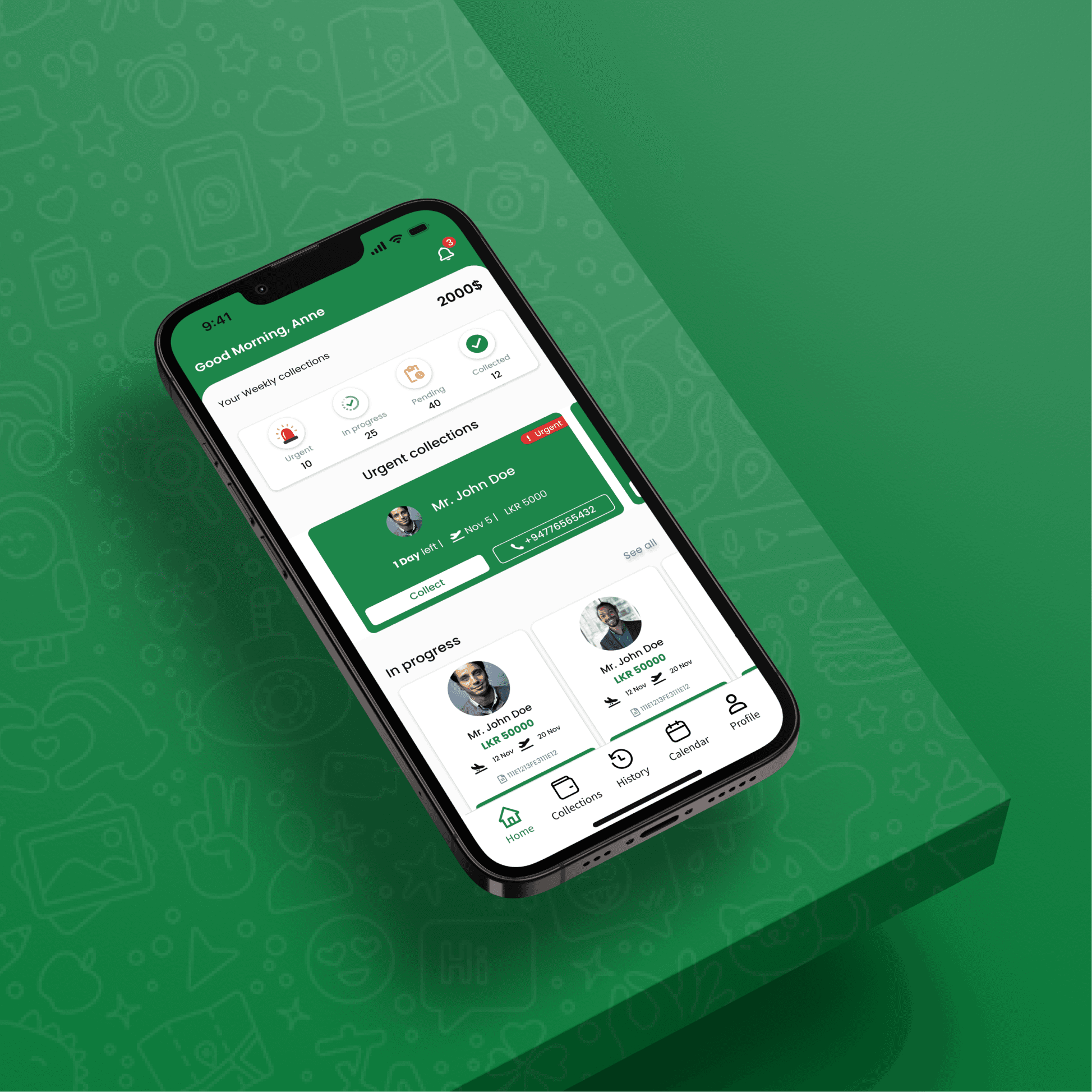

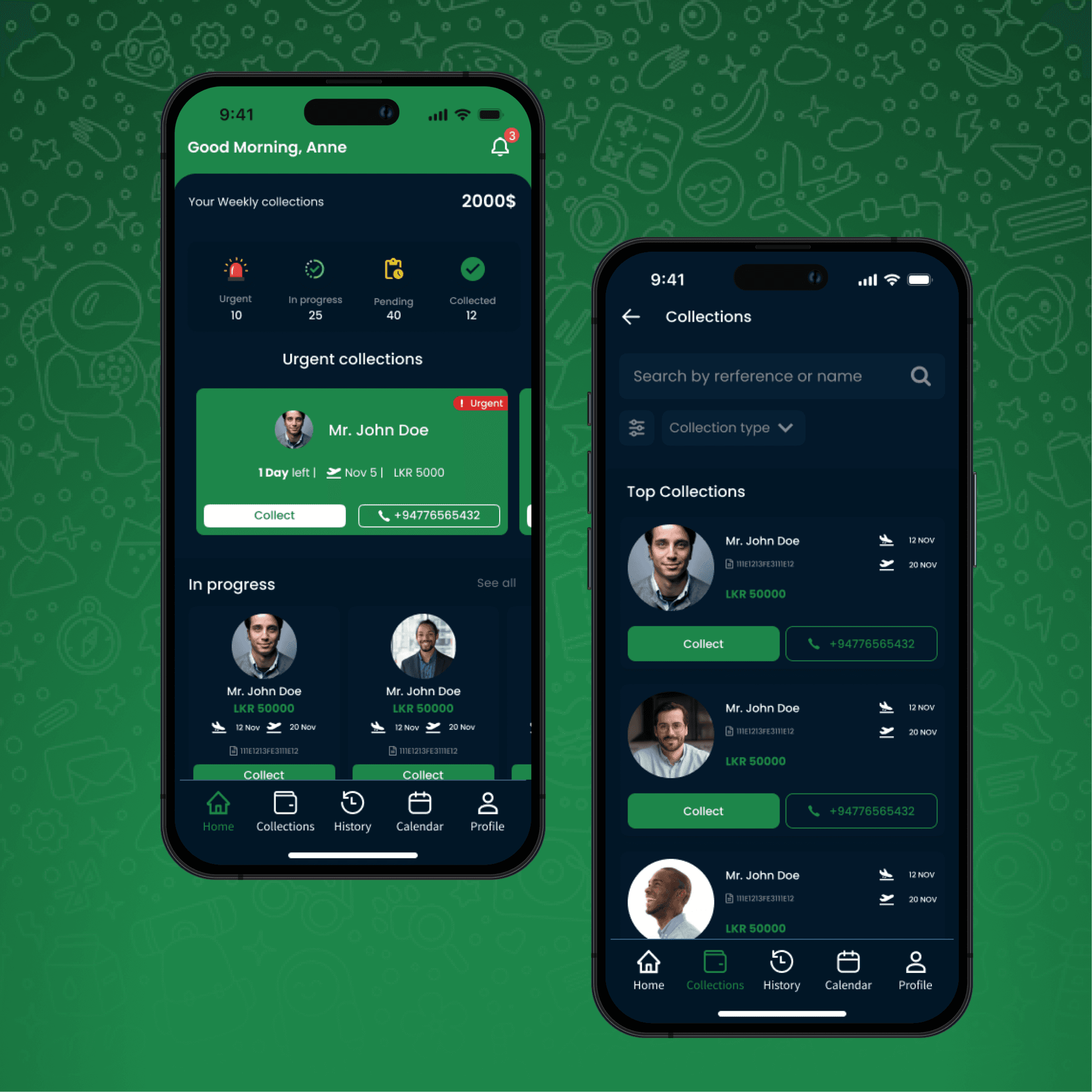

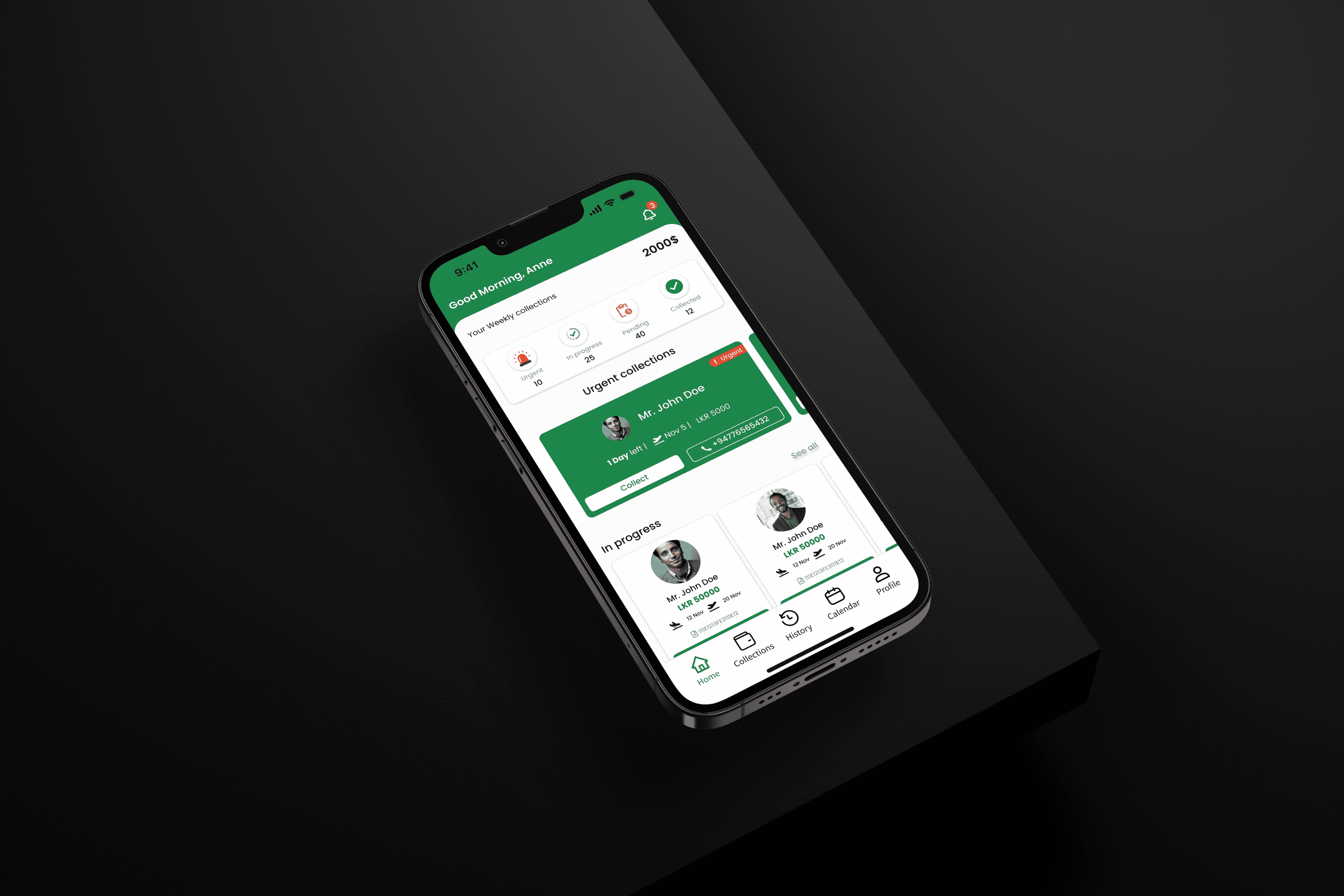

Home screen

The home screen design prioritizes urgent payments by prominently featuring them at the top for attention. In addition to urgent payments, non-urgent payments are categorized into two main sections: "In-Progress Payments" and "Pending Payments." In-Progress Payments represent transactions that have been partially paid, while Pending Payments means to amounts that have not been collected at all. This structured layout ensures a clear distinction and easy navigation for users to manage both urgent and non-urgent payments efficiently. Down below is UIs that is designed for home screen for the user.

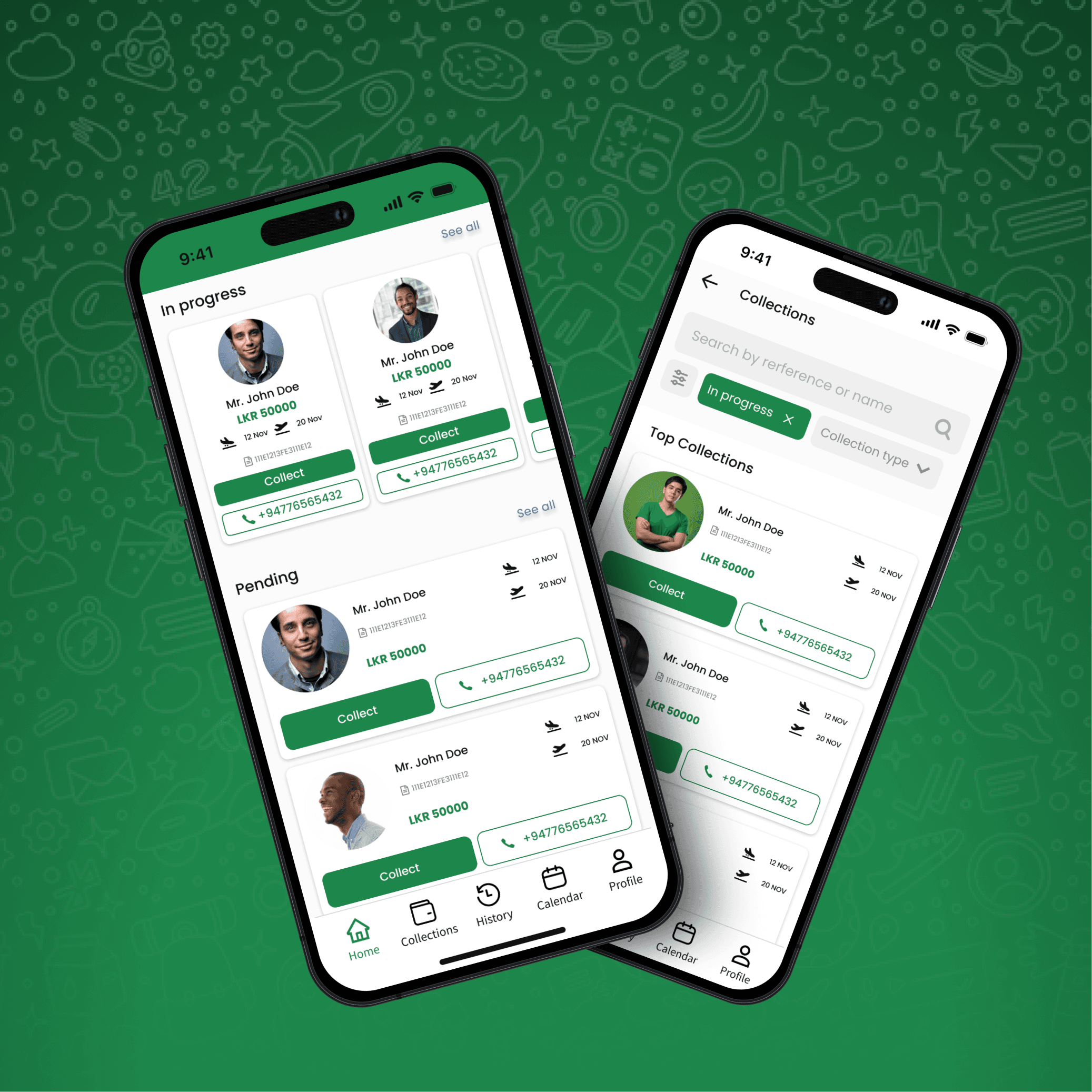

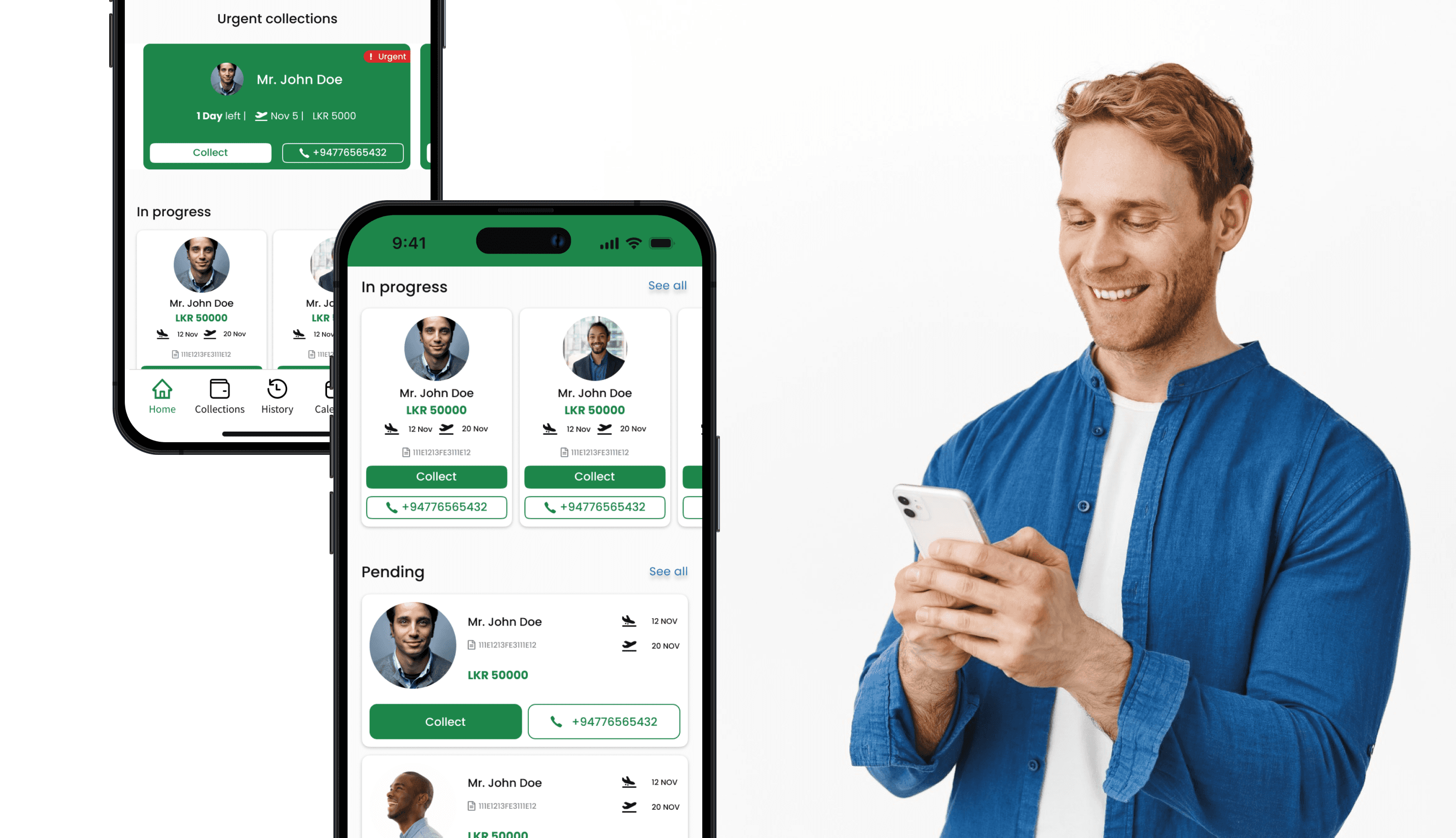

Collections screen

Collection screen displays all the collections assigned to the payment collector. They are given features sort all the collections by; urgent payments; in progress payments and pending payments.

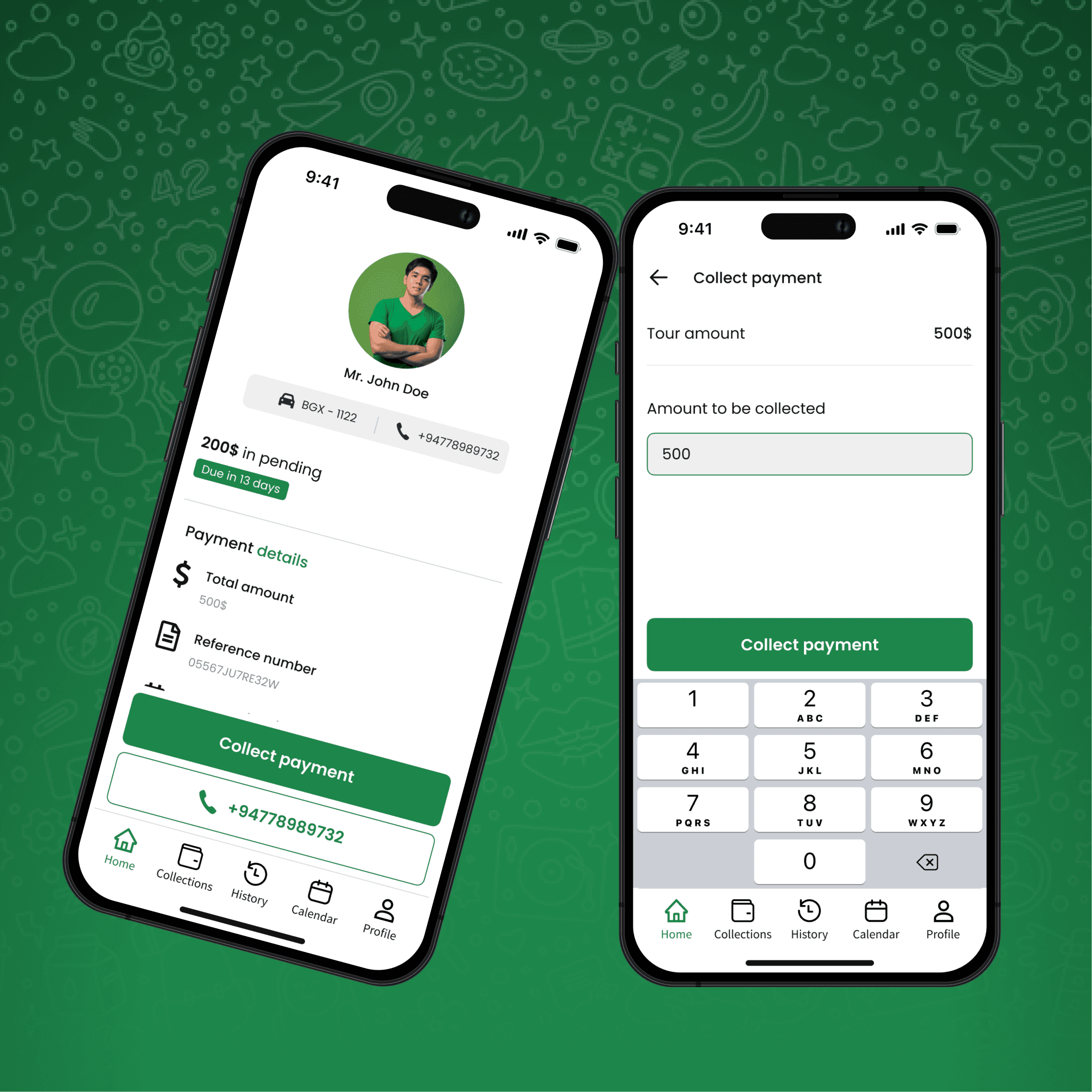

Payment screen

The Payment Details screen provides information regarding a specific payment. This screen is designed to offer convenient access for users to both collect payments and initiate a call to the designated payment collector. It ensures a seamless and efficient experience by centralizing payment-related actions in one easily accessible location.

Payment collect screen

The Payment Collection screen serves as the focal point for users, particularly payment collectors, to gather payments from drivers. Initially, the screen displays the default amount in a textbox, representing the total payment due. However, the collector has the flexibility to manually adjust this amount, allowing for partial payments.

Upon adjustment, the registered amount is recorded within the system, subsequently deducting it from the total. The net amount to be collected is then displayed, streamlining the collection process and providing a clear visual representation of the transaction. This user-friendly interface ensures adaptability to different payment scenarios while maintaining accurate records within the system.

Profile screen

As a drive can be a payment collector, the user has a feature to switch profiles. User can click the profile picture and do the profile transition. As well as, they can edit their profile details as well.

Conclusion

The conclusion is that, as the designer, I have understood and learned how to design mobile applications and keep it consistent with the design standards that are being followed. As well as improved on receiving design and feedback at the of iterations and applying them on the product for better User Experience.